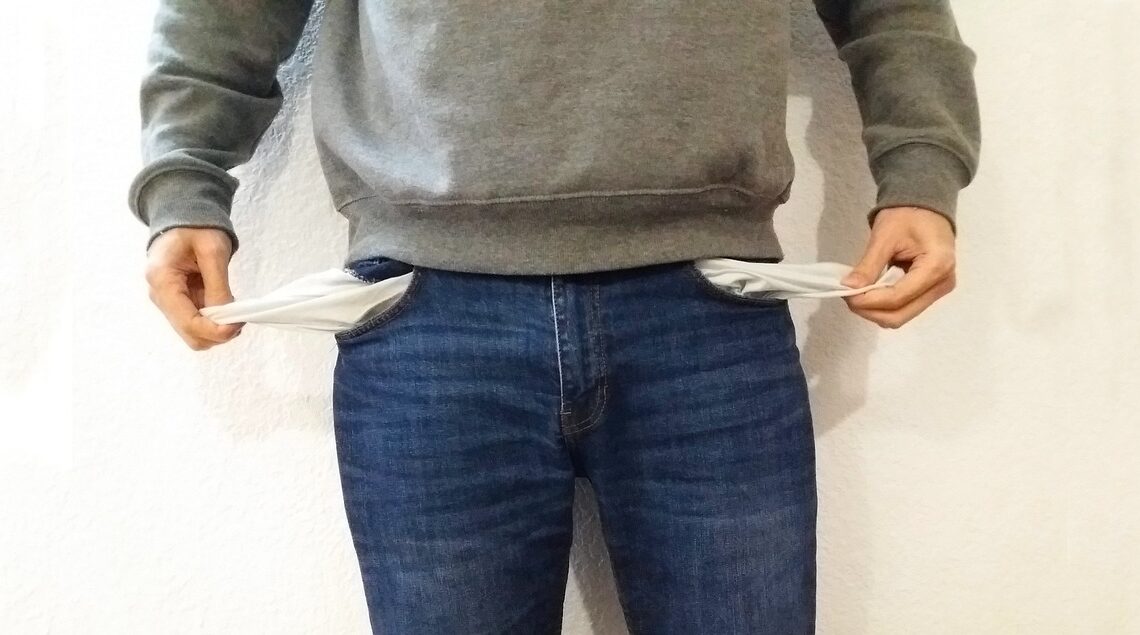

Why save when you can spend it all in one go? Why budget when surprises make life exciting (like overdraft fees and bounced rent)? If you’ve always dreamed of living paycheck to 3 days before paycheck, congratulations — you’re in the right place. Here’s how to ensure you never accidentally become financially stable:

1. Buy Things You Can’t Afford. Regularly.

Monthly income: $500

Monthly expenses: $1,493

The math? Not your problem. Swipe now, cry later.

2. Savings Are a Scam

Emergency fund? For what — emergencies? Please. Just rely on the ancient strategy of “I’ll figure it out when disaster strikes.” It builds character. And panic.

3. Ignore Your Bank Notifications

You don’t need that negativity in your life. Balance: ₵12.48? Mind your business. Those alerts are clearly just suggestions.

4. Live for the Aesthetics

Sure, rent is due, but those ₵1,200 sneakers are calling your name. Remember: looking rich is more important than being rich. No one ever flexed a savings account on Instagram.

5. Credit Cards = Free Money

Max them all. Minimum payments forever. Interest rates? That’s just capitalism doing its thing. Live a little. Or a lot.

6. Budgeting Is for Boring People

Do you really want to spend your Sunday night tracking expenses? Or would you rather buy three different kinds of iced coffee and wonder where your money went?

7. Never Invest — It’s a Trap

You could put ₵200 into a diversified portfolio and grow your wealth slowly… OR you could buy a mystery box online and maybe get a USB fan. Obvious choice.

8. Peer Pressure Finance

If your friend books a trip to Dubai, you book one too. Can’t afford it? That’s a future you problem. Besides, the pictures will be worth it (even if your lights are off when you get back).

9. Avoid Financial Literacy Like It’s the Flu

Why read a book about managing money when you could binge 7 hours of TikToks about people who already have money? Exactly.

10. Blame the Economy (and Astrology)

If all else fails, it’s not you — it’s Mercury in retrograde. Or inflation. Or your birth chart. Definitely not the 17 impulse purchases you made last week.

Final Thoughts:

So go ahead, ignore every smart financial move and ride the rollercoaster of broke-dom like the fearless thrill-seeker you are. Who needs peace of mind when you have an empty fridge, maxed-out cards, and a ₵80 scented candle?

You’re not broke — you’re just a misunderstood financial visionary.